Top 5 Things to Consider When Selling Scrap Metals like Gold, Silver, and Platinum

The sale of used metals such as gold, silver, and platinum can be immensely profitable if performed correctly and strategically to maximize returns. Changes in market rate, parity check, buyer choice, and unforeseen charges are imperative in determining the final payment amount. This article will walk you through the five most important factors before selling precious metals.

Factor | Description |

|---|---|

Market Value | Understanding price fluctuations and monitoring metal prices |

Purity & Weight | Determining the authenticity and weight of your metals |

Buyer Research | Choosing good buyers for the best price |

Transaction Costs | Determining hidden charges and payment terms |

Tax Implications | Understanding tax implications involved in metal sales |

Table of Contents

Understanding Current Market Value

Gold, silver, and platinum prices change daily based on the world economy, demand and supply levels, and geopolitical events. To sell, you must:

1. Track Market Trends:

Stay updated with financial news and metal trading websites like Kitco, the World Gold Council, or the London Bullion Market Association.

2. Know Spot Prices:

The “spot price” is the market price of one ounce of the metal. It serves as a benchmark by which buyers and dealers can be measured but can be sold at a discount to pay for refining.

3. Evaluating Economic Indicators:

Metal prices are most affected by inflation, exchange rates, and trends in the stock market.

According to Coherent Market Insights, the global precious metal industry will reach $533.12 billion by 2032, with a CAGR of 7.2% from 2025 to 2032.

For general information on selling gold, view our guide, The Best Way to Sell Your Scrap Gold.

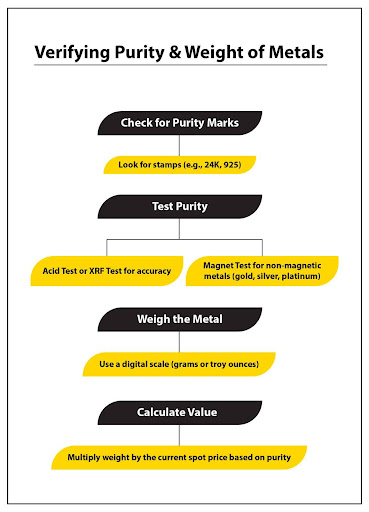

Maintaining Your Metal's Weight and Purity Accuracy

The worth of your metal depends on both its weight and purity.

Purity Levels:

Gold is measured in karats (pure gold is 24K). Silver and platinum coins are usually stamped with “925” (92.5% silver) or “950” (95% platinum). If no stamps appear, use a professional assay or acid test.

How to Test Purity:

Test Method | Description | Pros | Cons

|

|---|---|---|---|

Hallmark Inspection | Check for official stamps indicating karat or fineness. | Quick and easy method. | Counterfeits may have fake hallmarks

|

Acid Test | Uses chemical solutions to determine metal purity | Affordable and accessible. | Can damage the metal surface.

|

XRF (X-ray Fluorescence) Testing

| A non-destructive professional method for analyzing metal composition. | Highly accurate and non-destructive. | Requires specialized equipment and expertise. |

Magnet Test | Uses a strong magnet to check if the metal is magnetic.

| Quick and simple; detects counterfeit metals.

| Cannot determine actual purity. |

Weighing Your Items:

Record the weight using a digital balance in grams or troy ounces (1 troy ounce = 31.1 grams). This is utilized to approximate the price according to market rates.

Researching Potential Buyers

The most important thing is having the right buyer to avoid fraud and sell at the best price. Options include:

1. Online Buyers of Precious Metals:

Reputable online buyers can offer competitive prices due to lower overhead. Always review reviews and accreditations.

2. Local Jewelers & Pawnbrokers:

Selling locally offers face-to-face negotiation, but prices may be lower than those offered online.

3. Metal Refineries:

Direct refinery sales are usually high-return-generating but with a minimum order requirement.

4. Auction Houses & Marketplaces:

eBay, Craigslist, and metal exchange forums are websites where sellers can list their goods and find private buyers.

In a report, Earth Treasures Jewelers states that all gold buyers must display current purchasing licenses so you will know that they are selling to licensed buyers.

Ready to sell your scrap gold for top prices?

Being Informed About Transaction Charges and Conditions

Hidden charges can reduce your pay. Consider:

1. Appraisal & Processing Fees:

Some buyers have evaluation fees. Shop around by getting several quotations to compare prices.

2. Shipping & Insurance:

When selling online, make sure products are being shipped to prevent losses.

3. Payment Methods:

Some customers provide instant cash, while others are slow payers through cheques or bank transfers.

4. Comparison Shopping:

Compare several websites and dealers to receive the best price.

Read Top Mistakes to Avoid When Selling Your Gold Jewelry to prevent costly blunders that can eat into your profit margin.

Consider Tax Implications

The saleThe sale of precious metals attracts capital gains tax (CGT).

- Record Keeping: Maintain a record of payment receipts and selling and purchasing prices.

- Tax Laws: The regulations vary between states and nations. Tax practitioners are consulted to comply with them and predict future tax burdens.

- Long-Term vs. Short-Term Gains: In other industries, holding metal for over one year provides lower tax rates than short-term gains.

Frequently Asked Questions

Most gold items have a hallmark stamp (e.g., 10K, 14K, 18K). If the hallmark is missing, an acid test or X-ray fluorescence test verifies purity.

Online buyers typically provide competitive offers, while neighborhood pawn shops pay cash on the spot. Obtain multiple quotes to ensure the optimal price.

Market price, metal purity, weight, and buyer fee system determine the price.

Some buyers do not accept plated items, mixed alloyed metals, or jewelry with non-precious metals.

Final Thoughts

Selling scrap metals like gold, silver, and platinum can be profitable if handled cautiously. Remaining aware of prevailing market trends, guaranteeing your metals’ purity and weight, and conducting thorough research on the buyer will help you receive the best return on investment.

For those who want to sell locally, searching for cash for gold near me will help you find reliable places. Always provide a quote for the transaction and consider the tax side of your sale. Follow these steps, and you can confidently sell your precious metals for the best value.